If you’ve ever read an investment research article, a mutual fund prospectus, or almost anything related to the financial markets, you’ve probably run across the phrase, “Past performance is no guarantee of future results.” Want to know why you see these words so often? Because they’re true. While most of us certainly draw on previous experiences in order to make decisions about future courses of action, it’s vital to remember that, in the world of investing, the past is not a perfect mirror for what the future will be.

A good example of this is the comparative performance of different mutual funds, even when they’re in the same investment category. Many variables can cause two different funds—even when they hold the same types of assets—to have differing rates of return as measured over a short period. Something as technical as the precise timing of fund rebalancing, for example, can produce widely varying results over the short term, even if the two funds demonstrate very similar returns over the long haul.

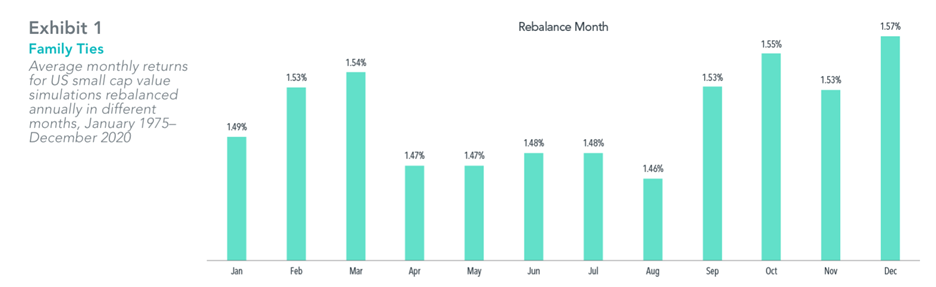

Consider the following chart, exhibiting the different monthly rates of return on an identical portfolio of small-capitalization stocks:

SOURCE: Dimensional Fund Advisors. Past performance, including simulated performance, is no guarantee of future results; indexes are not available for direct investment.

The only difference in these simulated funds is the month in which the holdings were rebalanced in order to stay within the parameters of the fund’s investment policy. And yet, the monthly rate of return varies from a low of 1.46% (17.52% annualized) to a high of 1.57% (18.84% annualized), depending on which month the rebalancing was executed.

Why would the rates be so different? Simply because the individual price movements of the various stocks making up the portfolio are inherently unpredictable in the short term. If the fund was rebalanced when a particular stock was riding high because of a favorable earnings report, that has implications for the fund’s performance. If, on the other hand, rebalancing occurred just after the announcement of a disappointing product launch, that will have implications, as well. And the fact is that no fund manager can predict, with perfect accuracy, which stocks in the portfolio will be up or down at any given moment.

This is just one illustration of why investors should not allow themselves to be distracted by the short-term “noise” around any investment. A financial publication may tout the outstanding performance of a particular fund, and you may think, “Why didn’t my fund do that well last month? It’s got the same holdings as the one in the news story.” But your focus should remain firmly fixed on the long-term view. Rather than chasing the latest “star,” investors will generally achieve better results, over time, by sticking with their long-term strategy and allowing the markets to work in their favor—as the markets have done for the majority of the time over the decades.

As a fiduciary wealth manager, Empyrion Wealth Management seeks to provide authoritative, research-backed information, so that clients can make solid decisions for their investments and other important financial undertakings. To learn more about “tuning out the noise” and other important principles of successful investing, click here to read our whitepaper, “The Informed Investor.”

Stay Diversified Stay YOUR Course!